#23: Notes on travel retail: in-person shopping

Booking travel is easier than ever, but choices are overwhelming. What can we learn from successful clothing stores? And what might a modern, in-person travel store look like?

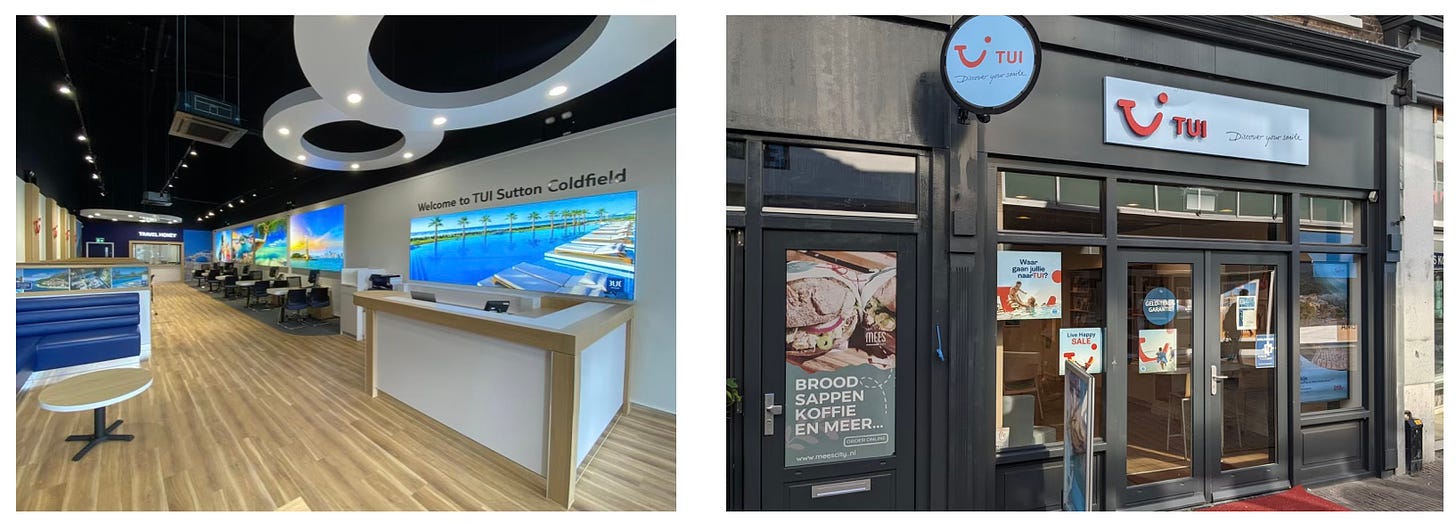

On commercial streets in Europe, you’ll often walk past a travel store. Some look tired, with faded posters and dusty ship models. Others gleam with advertisements for impossible deals - $325 for a week in Mallorca, flights included? How!?

In the US, travel stores are rare.1 Some travel agents have storefronts, but they’re really offices. The majority of business is conducted remotely (email me with exceptions, I’d love to hear about them).

Travel shops in Europe seem like an anachronism - a refusal to go online, built on habits from the pre-internet days of package holidays. The format of these shops blinded me to the potential of in-person travel retail, but there’s so much that could be done to serve the modern consumer.

The logistics-experience spectrum

I generally think about retail as sitting on a spectrum from logistics to experience. At the logistics end, you know exactly what you want and retail’s job is to provide the most efficient way to get it. At the experience end, you don’t know, and retail’s job is to help you, with ideas, suggestion, curation and service.

Ecommerce began at the logistics end, as a new and (sometimes) more efficient way to get something.

Benedict Evans, “Retail, rent and things that don’t scale"

The internet has made it fast and easy to book travel. I want to go to New York next month, so I compare flights and book in 5 minutes. Amazing.

But the improvement in logistical retailing obscures a problem at the experiential end of the spectrum. Travelers are taking longer than ever to plan trips, according to Skift. This is happening despite the fact that it’s easier than ever to book travel. The challenge is deciding what to book. William O’Connor’s quippy explanation:

There’s so much crap out there it takes forever to sift through it and ensure you don’t end up at the same shitty place as every other rube.

This problem can be solved many ways.

A non-retail solution is better “guidebooks,” unencumbered by social media algorithms, SEO, and AI-fueled enshittification of travel content. The new “guidebooks” are curated by trusted content creators or communities. Some examples:

El Camino’s membership community

Yolo Journal’s “black books”

Blackbird Spyplane’s “Global Intel Travel Chatroom”

Happy Hoteling’s country-specific hotel lists

Retailers have a role to play in reducing overwhelm as well. So much energy in the past decades has (justifiably) gone into “logistics” - bringing travel online and making it bookable. Now, there’s opportunity to improve “experiential” retailing - that is suggestion, curation, and service.

Retail clothing

For inspiration, it’s helpful to look at the clothing business. Shopping is increasingly online, but some retailers create compelling in-person experiences for their customers. Blackbird Spyplane interviewed a few examples of “the extremely rare, borderline-inconceivable-circa-2025 phenomenon of great stores that refuse to sell clothes on the internet at all.” The NY Times has noticed a trend, profiling several people who are bucking trends and running successful stores.

What’s driving the mini-renaissance of in-person shopping? A few themes emerge:

Customer relationships - Building genuine relationships with personalized service is the single best way to differentiate against the morass of internet shopping. BBSP interviewed Ben Ospital of MAC:

Their bread & butter lies in sustaining relationships with a local demimonde who A. trust their taste and B. have the money to splash out in the name of that trust, whether it’s on an isosceles-triangle Junya dress or an understated Dries suit. “We have great rapports with people going back years,” said Chris. “We know what they bought last season, so we can call them and say, ‘We just got in this skirt, come see it.’”

Curation & suggestion - A limited, well-chosen assortment adds value for customers. “It’s kind of like every single thing you could ever want in one location,” said a customer quoted in the Times about Van Space in Brooklyn. “They have an ability to say, ‘Oh, you like X, Y, Z brand, here are three other brands.”

Exclusive inventory - This is easier with vintage clothing. Stores like “What Goes Around Comes Around” pride themselves on their unique finds. Sarah Jessica Parker, a regular, was quoted in the NYT: “there will be only one of something there, not multiples of it. And that’s when vintage gets really special.”

Better in person - In our post-pandemic, work-from-home age, doing anything outside of home and away from devices is refreshing. “It feels nice to go and physically see stuff and physically try stuff on,” said Chris Kronner in the NYT, again about Van Space. “You can get so many brands in so many places online, it all kind of blends together into the same slog.”

“Rent is the new CAC”

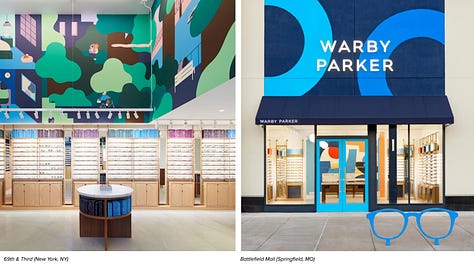

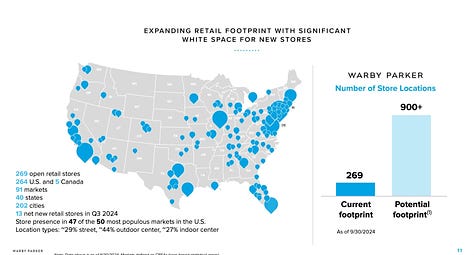

A few years ago, as digital-first brands like Warby Parker started building stores, it became a fashionable joke to say “rent is the new CAC [Customer Acquisition Cost].” D2C brands had started on the premise that cutting out middlemen and rent payments would allow them to offer a better value to their customers. As online ads became more expensive, running retail stores suddenly seemed comparatively cheap.

Benedict Evans summarizes it best:

All sorts of things that were previously separate budgets become part of the same question. Should you spend your acquisition budget on search ads or free shipping? Or a better returns policy? If you open a store in that city, can you spend less on Instagram, and do your returns go down or up? How do you reach your customers, and who are they?

For travel retailers, there are analogous questions. Does in-person booking allow you to better fit customers to a trip, leading to higher satisfaction and loyalty? If you open a well-located and well-designed store, will customers pop in frequently and reduce your acquisition costs? Will contact center usage go down?

The vast majority of travel, especially at the logistical/transactional end (flights, rental cars) will remain self-service and online. However, I think there could be room for a new kind of in-person travel retail.

Here’s what that might look like.

Luxury travel advisors and boutique tour operators

This is the most straightforward and highest potential.

Luxury brands invest heavily to create shopping experiences. Sure, you can buy items online, but it’s enjoyable to visit a beautiful store, browse the selection, and talk to the clerks. My favorite boutique is Bode - employees are friendly, the design builds excitement for the brand, and it’s fun to browse one-of-a-kind pieces.

Luxury travel advisors and tour operarators could offer similarly interesting (and beautiful) experiences. For example, it’s easy to imagine boutique tour operator Prior having a store. Clients could sit on a couch, have a drink, and talk to a knowledgable travel planner. To enable browsing and inspiration, there could be books, photos, maps, mementos, and museum-like displays related to trips on offer.

One thing to keep in mind: retailers shouldn’t necessarily eliminate their web presence. Many luxury consumers, especially younger ones, are “hybrid shoppers” according to Sia Partners:

70% of [millennial and gen-z] luxury purchases are influenced by online interactions, but 75% of transactions still occur in-store. To meet these dual desires, luxury retailers must embrace a unified experience across channels, delivering on expectations both digitally and physically.

Suppliers of complex travel products

What if a cruise line had a retail store? Customers could walk into mockup cabins and speak with knowledgeable salespeople. Interactive displays would show elements of the product and help customers make choices about shore excursions, dining times, and cabin position. Think of a Tesla store, with the cars in the middle and displays on paint colors, the charging network, and how electric motors work.

Travel brands with complex products - think tour operators and cruise lines - could benefit from in-person, experiential retail. Buying a cruise or packaged tour is not a logistical transaction, which is why OTAs have struggled in these categories.

A major concern would be channel conflict - precisely because these products are complex, they are heavily reliant on travel advisors. If a cruise company or tour operator opened a retail store, advisors might feel like the brand was trying to “steal” their customers.

While tricky, this type of channel conflict can be resolved. Most cruise companies allow guests to book their next trip onboard. In order to preserve relationships with travel advisors (who source most of those guests), the cruise lines take the booking and automatically assign it to the guest’s travel advisor, if that’s what they want. Companies could do something similar in their stores.

Experience superstores

What would the Eataly of travel look like? Warning: this gets a little cheesy. I could imagine customers browsing a superstore with themed environments reflecting the different places they might visit. A section for Costa Rica could be like the Rainforest Cafe, with piped in sounds and a “rainstorm” every 20 minutes. A France section would feature a “sidewalk” cafe.

Would the economics work out? I have no idea. At the very least, the success of Eataly and Mercado Gonzalez suggests a destination superstore would attract many visitors.

A few other elements

There are more ways to leverage the benefit of in-person shopping and counterposition against the internet. These could be layered onto any travel-related store:

Community - The explosion of run clubs, some member-driven and others organized around brands, shows desire for in-person communities built around an interest. I could imagine stores hosting travel-exchanges, where people share experiences from previous trips, get inspired for their next vacation, and meet travel companions.

Offline Deals - Physical stores present an opportunity. Travel suppliers often want “opaque” channels to offload unsold inventory (ways to sell without compromising public prices). Stores could offer offline-only deals that customers would need to come in to find.

Extreme Curation - The internet’s overwhelming choice presents an opportunity for limited, well-chosen options. The extreme example of this is Morioka Shoten, a bookstore that only sells a single book at a time (the book rotates each week). Could there be a travel store that sells one trip at a time?

Conclusion

The overwhelming amount of travel choices has created a need for experiential retail. I suspect we’ll see more niche travel retailers, with a blurring of the line between guide and travel seller. In the real world, there’s opportunity to create connection and experience around the purchase of travel.

Note that I’m ignoring travel agencies in immigrant communities, which are still plentiful in the US. These travel agencies sell travel aimed at a specific immigrant community, and they sometimes sell other things too - tax prep, shipping, money transfer, law services, notary etc. I’m setting those aside for this article, mainly because I don’t know much about them.