#11: Travel Agents: the misunderstood distribution channel

Travel agents are an under-appreciated and misunderstood distribution channel for travel products

Hi there! I’m Jess 👋

This is a newsletter about the travel business and taking better vacations.

It may surprise you to know that in 2024, travel agents book more than 50% of cruises. And it’s not just cruises. High-end hotels, all-inclusive resorts, and multi-day tour operators rely heavily on travel agents for customers.

After airline deregulation in 1978, US travelers had many more flight choices and turned to travel agents for help. Airlines also increased commissions, competing for the attention of agents. The increased number of travel agent flight bookings and the higher commission rates combined to make the late 1980s and early 90s a boom time for travel agents. At peak, more than 9% of all airline revenue went to agent commission payments.

Then came the internet. Expedia and Travelocity launched in 1996, and airlines cut commissions. By the end of the decade, payments had fallen so much that ticket-taker agencies were put out of business. Agents tried charging customers a booking fee to compensate. It didn’t work.

With the rise of the internet, the narrative around travel agents turned decidedly negative. Consumers could research and book on their own. When given a choice to book online, they seemed happy to book their own flights. Or at the very least, they weren’t willing to pay more for assistance.

But the move of flight ticketing online had a couple unique characteristics:

The airline industry is perfectly competitive. For the average consumer, airlines compete on price and schedule/network, both traits that are apparent when comparison shopping. Onboard products are not that different, and are unlikely to drive decisions for most consumers.

Digital tools were good enough for consumers to comparison shop on these key traits.

Flights have inherent demand. Customers know what they want, and they search for it. Even if they’re comparison shopping (is it cheaper to go to Miami or Cancun?), the world of possibilities is easy to grok. Just look at a map.

All these statements have caveats, of course, but they’ll serve as a contrast to other travel products later in this post.

So what happened to travel agents after the air-ticketing apocalypse of the 90s? The answer is simple: agents followed the money. Cruise lines, tour operators, all-inclusive resorts, and high-end hotels continued to pay healthy commissions.

Show me the incentive and I’ll show you the outcome - Charlie Munger

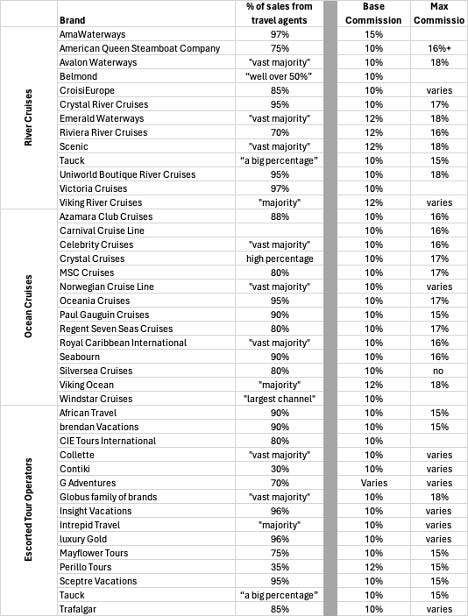

Commissions are purposely opaque, but Travel Market Report published a series of “report cards” in 2017-2019. Highlights are summarized in the chart below.

The full reports are worth a read, but you’ll notice two patterns in the chart above:

Agents earn commissions of at least 10%, and often as high as 18%. That means an agent would earn a couple hundred dollars for selling a cabin on a mass-market Caribbean cruise and several thousand dollars for booking a family on a high-end cruise.

Cruise and tour companies are highly reliant on travel agents as a distribution channel. Almost all companies source more than half of their customers through travel agents. Most high-end brands, such as Ama Waterways and Azamara, book more than 80% of their sales through travel agents.

Not only were commission rates high for these products, but volume increased significantly as well. In the 1990s, just as airlines were cutting their commissions, cruise lines started a multi-decade building boom. Predictably, cruises became an important business for travel agents.

Not only were cruises essential to the survival of travel agents, but cruise companies needed travel agents to support their growth. While airlines saw 10% commissions as a wasteful cost, cruise lines courted agents and happily paid even higher rates. They weren’t picky when they had so many new beds to fill. In some ways, marketing to agents was/is more efficient than marketing to consumers, especially for smaller brands that can’t justify huge marketing outlays. It’s easier to get your message across to tens of thousands of travel agents who are motivated to sell new products, not millions of consumers who are overwhelmed by choice.

Travel agents are an essential ingredient to growing a cruise brand. Renaissance Cruises, a high-growth cruise company from the 1990s, became the exception that proved the rule. In the late 90s, Renaissance built eight ships in quick succession. Inspired, I assume, by the trend of airlines cutting commissions, Renaissance capped travel agent commissions. Travel agents were furious, and some boycotted the brand (other cruise lines maintained their rates). A few years later, Renaissance reversed the decision but the damage was done and, in the aftermath of 9/11, the company went bankrupt. No cruise company has crossed agents since. Even Virgin’s new cruise line has intensely courted travel agents.

Aside from high-commission travel products like cruises and tours, agents in the “luxury travel” sector are thriving too. Many require clients to have budgets of $1,000/person/day plus planning fees. They plan really special trips for their customers - check out Wendy Perrin’s Wow List for examples. High-end hotels and tour companies market heavily to these luxury advisers through Virtuoso Travel Week, and forums like it.

I’ll end with a bit of speculation. Why are travel agents still so integral to the sale of high-commission travel products, especially cruises? There are a few reasons:

Overwhelming choice - There are so many choices, things like brand, destination, itinerary, and cabin-type. Unlike airlines, the products are quite varied and most people don’t want the cheapest option. Another difference: travel companies are often too small to have widely-recognized brands. Consumers appreciate help understanding their choices. While you can book cruises online, you need to know exactly what you want. As a result, most cruise bookings are done on the phone. For now, digital tools aren’t great at guiding customers through all the choices (some companies are trying to change that).

Curation/Suggestion - there’s not really inherent demand for a given leisure travel product. Travelers don’t search for Caribbean Cruises to Grand Cayman. They want a vacation with certain characteristics, and they need suggestions on what options to consider.

Free service - Because of healthy commission rates, agents can offer their services for “free” to travelers. Who wouldn’t want free advice? And if anything goes wrong, just ask your agent to call the cruise line.

Trust/Existing Relationships - Travel agents are seen as a neutral party, unlike a travel brand that only sells their own products. Most agents leverage personal networks to start their businesses, then grow organically through word-of-mouth and repeat business. There’s significant trust between good agents and their clients, and it’s easier for travel brands to tap into that trust than fight it. Remember, travel brands take direct bookings too. While some customers will buy directly, a customer with an agent relationship may only be reachable through that agent.

I was very sad when my travel agent retired, about 20 years ago. She knew the destinations, hotels, flight plans, and could design a trip worth taking. After she retired, I spoke with a few other agents, but would up doing it all myself. I would be very happy to find someone to do all of the legwork for a complicated trip.

Thanks for another very informative and interesting article. I always look forward to receiving your content, as should anyone in the travel industry or frequent travelers.