#20: Disney's "experiences" business and the growth of Disney Cruise Line

Disney announced the construction of four new cruise ships. What's behind the move? And what does this say about Disney's overall business?

A few weeks ago, Disney announced they were building four ships, in addition to the four they have on order. That will bring their fleet to 13 vessels in 2031, more than doubling from the current five.

I’ll be honest - my first thought was “I should have known.”

Recently, I was browsing Disney’s itineraries (as itinerary planners are wont to do) and noticed something strange: Disney just opened a second private island and they’re barely using it.

In the winter peak, Lighthouse Point (the new private island) gets 2-3 visits per week while their original private island, Castaway Cay, gets 4-5 calls per week. “They don’t need a new island at all!” I thought.

For comparison, Royal Caribbean schedules to 100% capacity at Coco Cay, their private destination - 2 ships per day, every day. Talk about maximization👇

I didn’t think much more about Disney’s underutilized island until I heard the announcement last month - Disney is investing heavily in cruise.

What’s driving all this investment? That question took me back to Disney’s vacation and theme park business and how it fits into the company’s overall strategy.

Here’s what I found:

1. Disney is increasingly reliant on “Experiences” for income and growth.

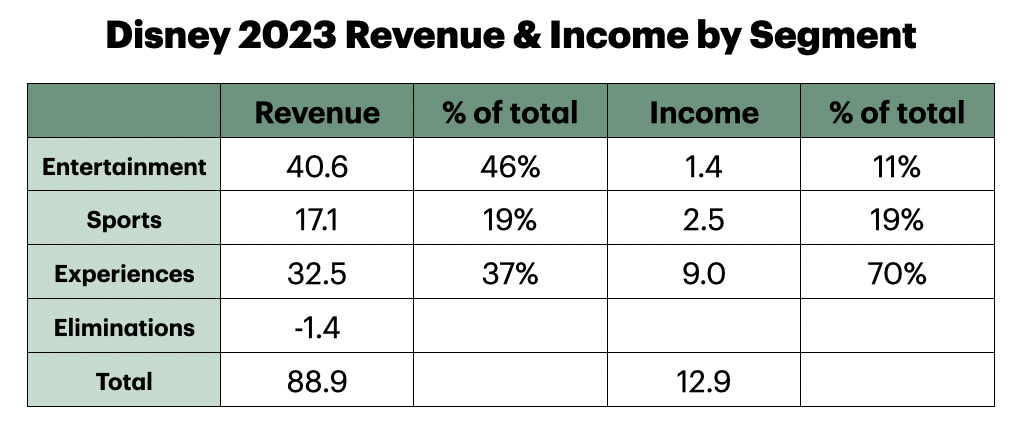

Disney divides its business into three segments:

Entertainment - movies, tv, streaming etc

Sports - ESPN etc

Experiences - theme parks, vacations, and merchandise

As you can see from the chart below, even though experiences make up 37% of revenue, they contribute 70% of operating income.

It may get worse. Entertainment income is sagging as Disney (and the world) transition to streaming from the previously lucrative film and cable tv business.

Sports is the hardest hit. In 2022, 71 million US households subscribed to cable. Every cable subscriber pays ESPN an average of $8.81 per month (through their cable provider), whether they actually watch ESPN or not.1

Cable subscriptions are declining. Of course, some people will switch to ESPN+ ($10.99/month or $14.99 when bundled with Disney+ and Hulu), but it will only be people who watch sports. In other words, ESPN has already hit peak subscribers. Disney is trying to make it a “digital platform,” but success is uncertain. The story is similar for film (with declining movie attendance) and Disney’s other TV businesses (with the switch to streaming from cable).

All this bad news leaves “Experiences,” Disney’s catch-all bucket for theme parks and vacations, as the main area for growth.

As we look forward, there are four key building opportunities that will be central to our success: achieving significant and sustained profitability in our streaming business, building ESPN into the preeminent digital sports platform, improving the output and economics of our film studios, and turbocharging growth in our parks and experiences business [emphasis mine]

-Bob Iger in Disney’s 2023 earnings announcement

Even though Disney plans to “turbocharge” the Experiences business, they still need high-quality stories and characters. If you haven’t seen this 1957 drawing by Walt Disney, it shows the synergies between Disney’s creative engine (theatrical films) and experiences (at the time, only Disneyland). The business has grown since the 1950s, but the core dynamic is the same. In our age of streaming and declining movie attendance, Disney relies on theme parks and vacations to make most of their profit, but TV and film are how they drive demand for those experiences. You can’t have one without the other.

2. “Experiences” is a diverse business, and Disney is growing it in multiple ways.

The largest component of “Experiences” revenue is not really an experience. It’s Disney’s retail, merchandising, and licensing - everything from Disney Stores to Uniqlo partnerships makes nearly half of the “Experiences” business and 16% of Disney’s overall revenue.

Theme Parks and Vacations collectively make up 21% of Disney’s revenue. In 2023, the company announced they were doubling investment in these two areas, pledging to invest $60 billion over 10 years.

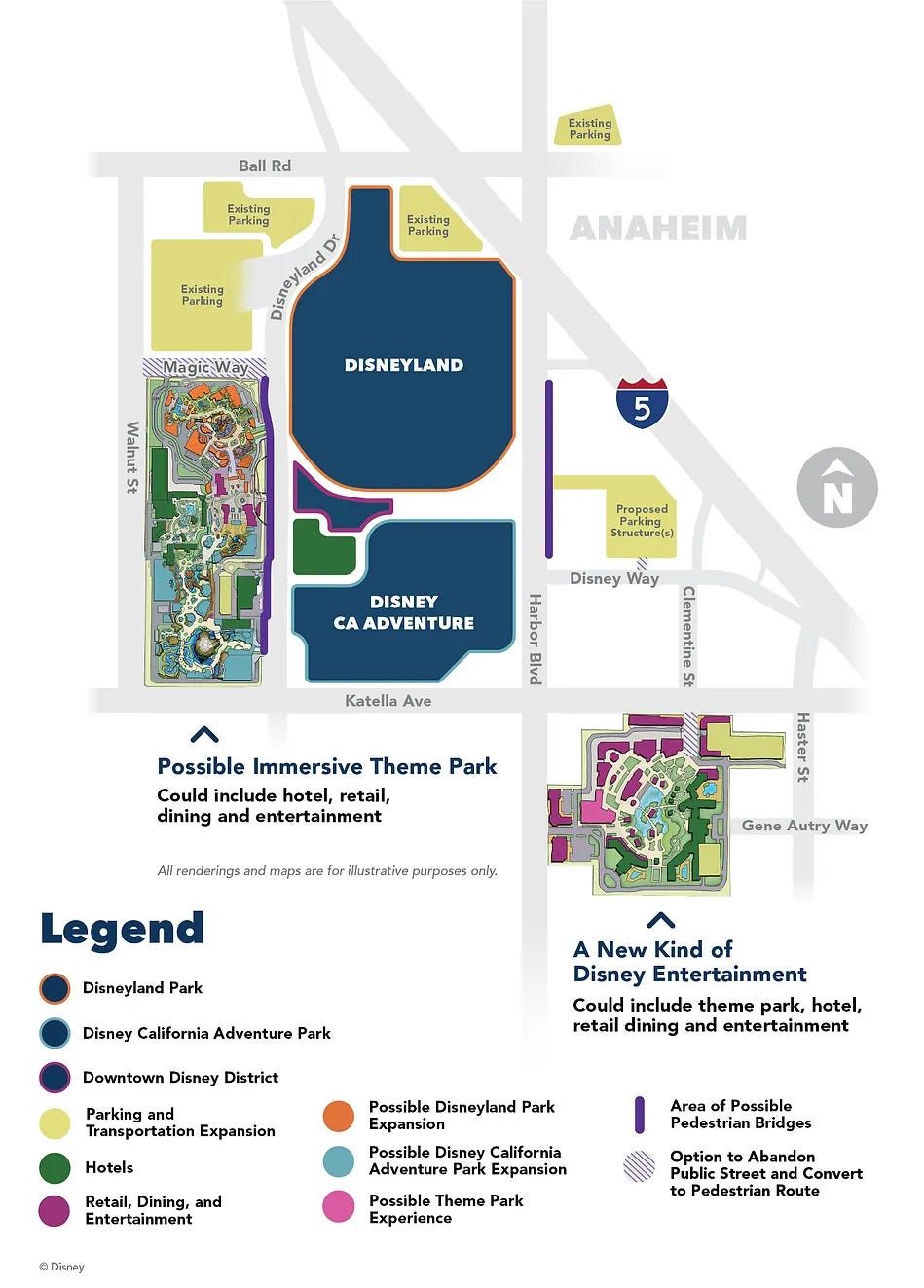

Most theme parks will get new attractions and expanded land area. Here’s an example that was recently approved in Anaheim 👇

The Resorts and Vacations segment is really varied, and I haven’t found a breakout of revenue and profit. It’s safe to assume that the cruise line and the timeshare business (Disney Vacation Club) are the largest segments, but there are a few interesting areas of experimentation:

Aulani, a resort in Hawaii with 351 hotel room and 481 timeshare units, hints at potential Disney hotels in other locations. Maybe a Mexican beach destination could be next? I could imagine a good Coco tie-in.

Tour Operations (National Geographic and Adventures by Disney) - the two brands mostly sell high-priced tours, but I could imagine them lowering prices and increasing volume. ESPN is getting in the game too.

Storyliving planned communities - Disney is building master-planned neighborhoods and selling homes in them. The first two are in the California Desert and North Carolina.

3. Disney is increasing theme park prices and creating new upsells, but there may be limits.

With its increasing reliance on experience, the company is squeezing theme park attendees for all they’re worth.

Disney World peak-day prices have increased 90% in the last decade (inflation was 33%) according to All Ears. And that doesn’t tell the whole story - many guests now pay an additional $15-35 for Genie+, which allows you to “skip” lines (read: wait in a shorter line with all the other Genie+ people). Free airport shuttles were discontinued in 2021 and now cost $13-16/person. The “opportunities” to spend more are everywhere. To use an airline metaphor, they’ve raised fares and increased ancillary spend.

It’s no wonder The NY Times recently asked “Are Disney vacations still worth the price?” followed a few weeks later by a profile of families going into debt to fund their trips. Despite the hand-wringing, the first article ends this way…

Greg Antonelle, the managing director of MickeyTravels, a travel agency that focuses on booking Disney trips, said his company is having a great year […]

“We’ve been in business for 13 years and we’ve heard complaints about cost for 13 years,” Mr. Antonelle said. “It’s nothing new.”

Disney has pricing power. It’s that simple.

But I also wonder how much more they can squeeze customers before they rebel. It’s hard to tell, but it seems likes there’s more grumbling than normal.

4. Disney Cruise Line has incredible pricing power.

Nowhere is Disney’s pricing power more obvious than their cruise business. Just look at this example from equivalent February 2025 cruises on Disney, Royal Caribbean, and Carnival.

A family of four in a balcony cabin (the most common category) needs to pay 255% more on Disney than on Carnival’s newest class of ship ($9,820 vs $2,766). I’m speechless.

There are many factors that determine overall ship revenue - What proportion of cabins have 4 people vs 2? How many were sold at discounts? How much do people spend onboard?

These factors might narrow the gap a bit (Disney has no casinos, for example), but it’s safe to assume Disney commands a hefty revenue premium.

From a profitability perspective, Disney likely has higher costs. For example, I’d guess they spend more on entertainment. Their ships are also more spacious, which means they carry fewer passengers for approximately the same fixed capital and operating costs. Disney’s ships have 28-68% more space per person than Carnival Celebration, depending on you look at it.

Again, these factors may narrow the profitability gap but it’s safe to assume that Disney’s ships are cash machines.

5. Disney Cruise Line will grow faster than the industry, but growth is more modest than it seems.

When you have pricing power, there are two conflicting impulses:

Impulse 1: Grow! There’s clearly lots of demand for Disney’s cruise products.

Implication 2: Be careful! If you want to maintain high prices, keep capacity limited.

For the last few decades, Disney Cruise Line grew very slowly. The company had better places to invest their money and/or the cruise business needed to mature to profitability. According to filings in the UK, the cruise business wasn’t profitable until the mid 2010s, after the arrival of their third and fourth ships (though I’m skeptical of taking this loss at face value, see “Further Reading” below).

Reported profit shot up starting in 2015. A few years later, Disney started a building spree - going from four ships to seven in 2025 in the core North American market. Additionally, Disney ordered & licensed two newbuilds for Asia - one in 2025 will homeport in Singapore and another in 2028 will operate from Japan.

Given the nature of cruise bookings, which happen many months in advance, Disney has good visibility to how pricing is holding up after all this growth in the core North American market. Judging by the February 2025 fares (and Disney’s decision to order more ships), we can guess the near doubling of the fleet is going well.

We also have this tidbit from Disney’s CFO Hugh Johnston:

[cruise ship investments] 'tend to pay back very quickly. So we certainly feel positive about those investments.'

-recent earnings call, via Seatrade Cruise News

To summarize:

Disney Cruise Line is currently absorbing its largest growth on a percentage basis, going from 4 ships pre-pandemic to 7 ships in 2025 in their core market.

They seem to be maintaining pricing power.

Future growth will be more modest on a percentage basis if you assume older ships will retire at 30 years. The fastest proportional growth is now.

Some of the new capacity will be deployed to new markets, further moderating growth in any one market and reducing the risk of weak pricing.

We’ll see how Disney Cruise Line absorbs this capacity over the next seven years and how the Asia expansion plays out.

Building cruise ships is easier than building new theme parks. New cruise ships (and other leisure experiences) also allow growth without forcing Disney to increase theme park prices and alienate loyal customers. In my opinion, there’s plenty of room for Disney to grow its cruise business, and I suspect they’ll continue to direct their investment dollars towards it.

📚 Further reading 📚

Magical Cruise Company, Ltd is the UK entity that owns Disney Cruise Line. They are required to make public filings, so we have some visibility into the cruise company’s profitability. According to a Forbes analysis by Caroline Reid, the cruise line wasn’t profitable until 2014. However, I wonder what Disney charges its UK entity for intellectual property and services like Imagineering etc.

The Spectacular Failure of the Star Wars Hotel - a four-hour review of the now-closed Star Wars hotel that was at least $2,400 per person for two nights!

The Palace Coup at the Magic Kingdom - how Bob Iger’s succession plan failed so badly and returned Iger to the CEO job at Disney

Acquired episode on ESPN - The cable sports business printed money for decades. This episode tells the story of how ESPN was built.

Acquired episode on Disney+ is also helpful to understand Disney’s legacy media business and how it’s adapting to the internet age.

Disney 2023 Annual Report - the source of many of my numbers, in addition to this announcement.

What a great article! Thanks Jess.

I do wonder how the baseball trip experience ended up doing for them. and if/how they’ll lean more into sports just given how much growth sports tourism has seen and is projected to have.