#6: A redemption narrative: the history of Viking Cruises

How Viking became the largest and fastest-growing premium cruise brand

Hi there! I’m Jess 👋

Bureau of Adventure is a newsletter about the travel business and how to take better vacations.

This is the first of a two-part deep-dive on Viking Cruises, one of the fastest-growing, high-functioning travel companies of our time. Part one is focused on the history of the company. Part two is focused on broadly-applicable lessons from this history, and you can read part-two here.

Lastly - if you don’t already, you can subscribe to get the latest pieces in your inbox!

Today, Viking is a multi-segment cruise company and the largest premium travel brand aimed at English-speaking travelers. They’re the Kleenex of river cruising, with absurd brand recognition and ~80 river vessels compared to 20-25 for the next largest brands (AMA, Uniworld, Avalon). In the ocean cruising world, Viking operates nine high-end ships, which puts it on par with the largest competitive brands (Silversea, Oceania). However, they have eight more ships on order while those other brands have one each. By the end of the decade, Viking will be the largest brand in high-end ocean cruising, just like it dominates river cruising today.

Viking is privately held, and they’ve been excellent myth-makers in the travel and business press. In this piece, I’ll synthesize the history of Viking as best I can and fill in the gaps with educated guesses. Let me know what I’ve missed, and I’ll update this piece. Thanks! 🙏

Phase 0: Before Viking

You can’t tell the story of Viking without telling the story of Torstein Hagen, the company’s iconoclastic (and mythologized) founder. Born in Norway, Hagen moved to the US for business school before becoming a McKinsey consultant. At McKinsey in the 1970s, he worked on a project for Holland America Line and was hooked on the cruise business (I know the feeling 🤓).

In 1980, after a few twists and turns, Hagen became CEO of Royal Viking Line, the first luxury line of the modern era. In 1984, Hagen tried to engineer a management buyout of Royal Viking but was instead outbid by Norwegian Cruise Line. They acquired the company and pushed him out. Royal Viking languished as a subsidiary of NCL and eventually shut down in the 90s. Meanwhile, Hagen stayed away from the cruise business (mostly). He made some money investing and then lost almost all of it. At one point, he had to sell the art off his home’s walls to cover a margin call. With a string of failures, Hagen had something to prove.

Phase 1: The founding (1997-2000)

Viking’s early years are a bit murky, since the company’s narrative wasn’t really told until the 2010s.

We know the company was founded in Russia. Hagen had business connections there and, with some help, he purchased his first four river vessels.

He got back into the Russian equity market […] by helping "a couple of oligarchs buy a shipping company." In return, "they let me have four ships cheap, and I started Viking River Cruises in 1997."– Travel Weekly

Viking soon established its headquarters in Switzerland and acquired or chartered more ships, but the details of this period are not clear. If they acquired ships, my guess is they had existing distribution, likely large European tour operators and travel agencies accustomed to buying space on those ships. In those days, river cruising was mostly for Europeans.

Phase 2: The first decade - KD Acquisition and North American expansion (2000-2011)

In 2000, Viking made two big moves which would lay the groundwork for the next decade.

First, Viking acquired German river cruise company KD in March 2000. The acquisition gave Viking additional capacity, bringing the total size of the fleet to 26 ships. Many ships remained dedicated to the European market, sold through KD’s existing distribution. KD also had another asset: the rights to prime docking locations in European cities.

Second, Viking opened a sales & marketing office in the US and started investing heavily in the US market. From the start, they were ambitious:

Rudi Schreiner, president of AmaWaterways, opened Viking's USA office in 2000 and recalls its board's early vision of building up to 50 ships within a short period. That ambition was delayed, he said, by 9/11. - Travel Weekly

The 9/11 slowdown may have been a blessing in disguise, because it allowed Viking to methodically build a high-performing sales & marketing operation. They invested in their US distribution by educating travel agents and paying them hefty commissions while also marketing directly to consumers. At the time, high-end cruise companies were hesitant to market direct to consumers for fear of alienating travel agents. Viking rejected this tradeoff with generous treatment of travel agents but an insistence that they needed to correspond directly with their end customers.

We are not direct sellers, we are direct marketers […] We need to have a direct conversation with consumers; and own our product, delivery, pricing, and yield. We are not concerned whether customers buy with travel agents, which have always been an important component of our businesses, but we do care that they buy a Viking product. - Hagen in an interview with McKinsey in 2020

This direct marketing push was expensive. Hagen claimed they had spent $400 million on marketing from 2003 to 2013. By 2019, he claimed to have spent $1.5 billion cumulatively. This had three major benefits:

Viking’s share of direct business was higher than competitors, saving on commission payments (at least 12% of the value of the cruise).

Viking became the default brand associated with a new category, river cruising.

Viking could more nimbly drive demand to products that needed attention.

When there is a ship to be filled -- in, for example, Europe during the slow months of November and December -- "then we put it in the mail. We can stimulate demand, whereas our competitors just sort of sit there and wait for customers to call them, or call travel agents." - Hagen in Travel Weekly

Although not stated in these glowing profiles, Viking had another realization during this period: the premium North American market was more profitable than the European markets it had started in.

Viking also began tailoring its product to American tastes, dedicating 14 of its 28 ships to the English-speaking market. “We wanted to provide a consistent experience for our guests,” Hagen explains. To appeal to Americans, Viking designated the ships non-smoking, served lighter cuisine, and introduced hotel-style beds instead of the more common fold-down berths and sofa beds. - Maritime Executive

And it wasn’t just any American traveler. Viking specifically went after mature, curious couples - those with the highest spending power and the most time to travel.

“Don’t try to be everything to everyone,” Hagen likes to say, and Viking didn’t. The targeted demographic was mature couples with inquiring minds and a lively interest in history, culture and geography. Hearkening back to his Royal Viking days, Hagen focused on the destination, creating cruises to take advantage of local festivals and programs and including shore excursions in each port to immerse passengers in the regional culture. - Maritime Executive

During this period, Viking started offering trips to China, Egypt, and Southeast Asia in addition to their core market of Europe, but these remained niche products on chartered ships. Overall, it’s not clear that Viking’s capacity grew much in the 2000s. It’s an imperfect measure, but the net number of ships on their website remained approximately flat during this decade (thanks archive.org).

What we can say is Viking built a reliable sales & marketing operation - a “demand machine” - in North America. They were aggressive marketers and ready for growth. In 2013, they decided to focus exclusively on the English-speaking market, shutting down their sales office in Germany.

Phase 3: The Longship Invasion (2012-2015)

In March 2011, Viking announced they would launch four river vessels the following year. They would be called “longships.” Six months later, they announced two more vessels would be launched in 2012 due to “overwhelming” demand. It wasn’t a fluke.

Over the next few years, Viking would host dramatic ceremonies every year where they inaugurated multiple ships at the same time. In 2012 they introduced six ships, followed by 10 in 2013, 16 in 2014, 12 in 2015, and eight more in 2016. They even won a Guinness World Record for these ceremonies. By 2022, Viking had built more than 60 longships or near-copies (some rivers can’t accommodate full-size longships, so Viking has built smaller versions).

What made the longships so successful?

Balconies - While the ocean cruise industry had widely adopted balconies, they were just starting to appear on river vessels. 75% of cabins on Viking’s longships had balconies (French balcony or full balcony), which helped make river cruising familiar to the wide audience of experienced cruisers.

"It's clear that many people want to go from ocean cruising to river cruising, and people who have been on ocean cruises want balconies." - Hagen in Travel Weekly when longships were announced

Nordic minimalist design - Longships feel spacious and modern. At the time, many river ships had dated interiors that made them feel small and cluttered. Some river brands have a maximalist, almost baroque style that feels - I’d argue - nostalgic and frumpy to ocean cruisers. Viking’s design made river cruising broadly appealing. You can’t go wrong with Scandi design.

Efficient use of space - River ships are constrained by the size of locks. Viking’s longships packed 190 passengers into the space that other ships accommodate 160-170. How? They eschewed amenities like a gym and spa, using that space for cabins instead. The forward part of the ships had three decks when other river vessels had two and they squared off the bow. All this helped profitability and made the business case for growth easier.

To fuel all this growth, Viking needed high brand-awareness. Starting in 2011, at the height of the Downtown Abbey craze, they became the sponsor of PBS’s Masterpiece Theater. During primetime, advertisements for Viking River Cruises were interwoven with the mostly-British shows. Keep in mind, PBS has very little advertising so Viking stood out even more. Today, Viking remains the main sponsor for PBS’s Masterpiece Theater.

“Our partnership with Masterpiece is successful largely because of similarities between our audiences,” said Richard Marnell, senior vice president of marketing for Viking River Cruises.

“Viking’s guests, many of whom are Masterpiece viewers, enrich their lives through history, culture and exploration. We strongly believe in marketing the Viking experience to like-minded travelers,” Marnell said. - Travel Weekly

I encourage you to watch one of the ads here. It’s only 30 seconds, and you get a perfect sense of how Viking speaks to their clientele.

Phase 4: To the Oceans (2015-2020)

In 2013, Viking shocked the cruising world when they announced an ocean cruise division. At 930-passengers, Viking Star would offer an equivalent to Viking’s river product and appeal to the same demographic. The destination would be the focus, with long stays in port and little onboard entertainment. Fares would include shore excursions, wifi, and beer & wine at meals, just like Viking’s river ships.

While high-end cruise companies had existed for decades, Viking didn’t clearly fit into existing categories - they defined their own. Was it a “luxury” product like Silversea? In the cruising world, “luxury” implied fussy service, formality, and included alcohol. Viking’s bundle of inclusions was different, more oriented toward value and ease, and the onboard style was low-key - no formal nights or awkward butlers. Some customers of existing luxury lines would be interested in Viking, but the product was different.

People in the industry were skeptical, or they thought the potential was limited to Viking’s existing loyal customers. They were wrong.

Similar to the longships, Viking started stamping out copies of their ocean ship, approximately one per year. They’re currently at nine ships, with eight more on order through 2028. In capacity terms, one ocean ship (930 pax) is equivalent to five river longships (190 pax). As Viking becomes larger and as European rivers became increasingly congested, ocean cruising was the obvious way to scale the company.

And if we’re honest, this was probably Hagen’s plan all along. It was no coincidence that the first four Viking Ocean ships were named Star, Sky, Sea and Sun - the same names of the four ships in the Royal Viking Line. Torstein Hagen was back, and in a big way.

The Viking Ocean ships were designed for worldwide itineraries - from Norwegian Winters to summers in the Mediterranean to 180-day world cruises. To get a sense of what the ships look like, check out this 360 tour.

What made the ocean product a success? Three key ingredients:

River-cruise style - the destination-intensive itineraries, inclusive fares, and low-key onboard environment differentiated Viking from other oceangoing ships. Viking had done their homework, and there was clearly a hunger for this type of experience.

What the ships didn’t have - Viking was very clear about who their demographic was (mature, curious English-speaking travelers) and who they were not targeting (families, children, or travelers interested in fussy “luxury”). Furthermore, their inclusive pricing model allowed them to eschew annoying anciliary revenue games (photo sales, art auctions etc). This allowed them to create a calm, easy environment that their demographic loves.

From Viking’s website. The whole “Why Viking” section is a masterclass in travel marketing The physical design of ships contributed to this sense of calm and lack of fuss. Rottet Studio and SMC Design created a minimalist but warm look that felt residential. All cabins had a balcony and spacious bathroom, both luxuries on ships. In public areas, there were tons of windows, double-height spaces, indoor/outdoor areas and open decks. You could imagine yourself spending weeks or even months onboard.

Phase 5: Continued Growth & Possibilities (2020-today)

I get the sense that, in the mid 2010s, Hagen started working on all the fun projects they had shelved for the sake of focus. Several came to fruition between 2020-2022, and they suggest potential new avenues for growth.

First, Viking continued its expansion in China. In 2016, Viking opened a sales office in China and began offering Mandarin-language cruises in Europe. On the eve of the pandemic, Viking had multiple longships in Europe operating fully in Mandarin, with food, staff, and tours customized to affluent Chinese travelers. In 2021, Viking took the push into a China a step further by transferring one of its ocean ship to a joint-venture with China Merchant Group. Together, they are starting China’s first high-end cruise brand and plan to add more ships. How big will Viking’s China push be? While there is significant risk, China presents the largest opportunity for Viking in the coming decade.

[We] noticed 80% of Chinese were seeing Europe on a bus tour, and there was a large core of those people who didn’t know how else to do it, but they had the means and desire for something better. The situation was weirdly analogous to America 20 years ago, but the offerings were far worse. […]

Sophisticated people from tier-one China who didn’t want to undertake solo travel needed something more. We wanted to offer an equally good product to Chinese guests as we did to Americans. So we did focus groups, asking: what do you really want, what annoys you when you travel, what scares you? When we take American guests on the Yangtze River, they want to try Chinese food, but do they want it for breakfast? Never. It’s the same for the Chinese guests, and the cruises are designed to give them as much of a taste of Europe as they want, but with the comforts of home. - Brendan Tansey in Dragon Trail

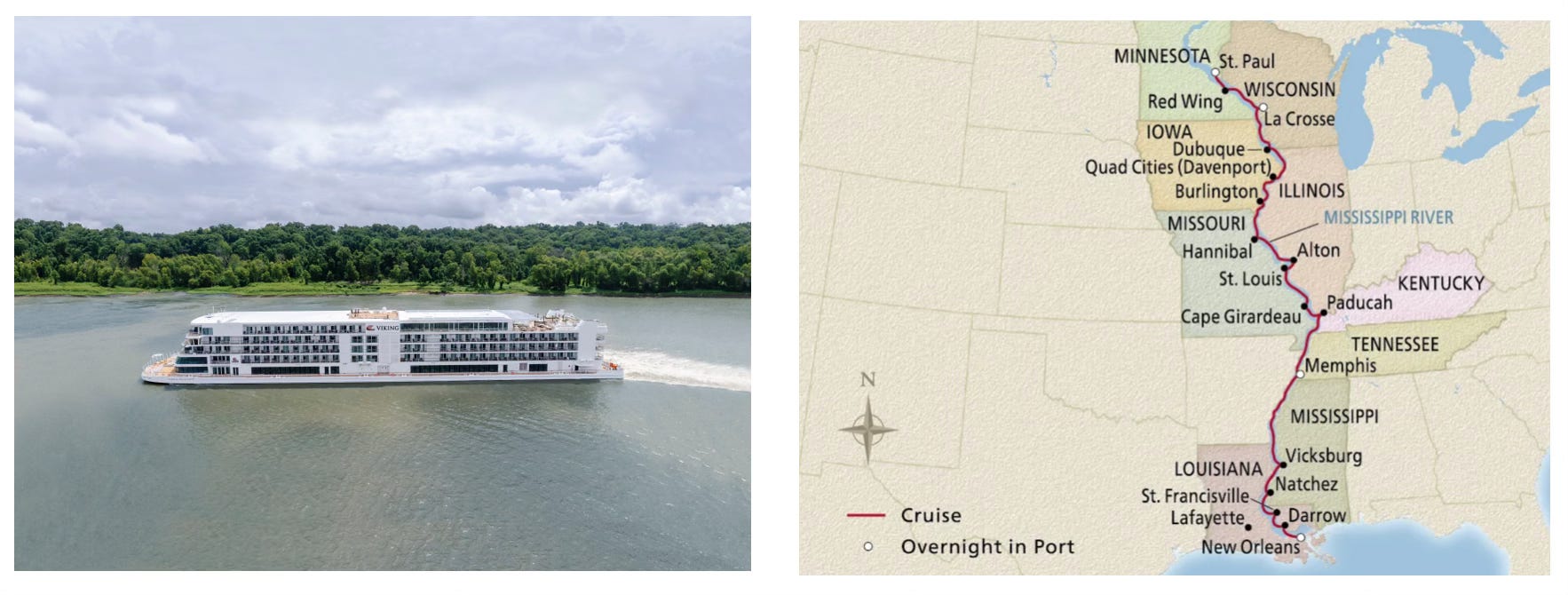

Second, Viking completed the construction of their first US-flagged vessel: Viking Mississippi. As a foreign company, Viking is not allowed to own a US-flagged vessel, so they had to find an American owner willing to partner with them. It took seven years from their first announcement, but they did it. Will Viking introduce more US-flagged vessels in the future? They could offer products similar to American Cruise Line, which is on its own growth journey.

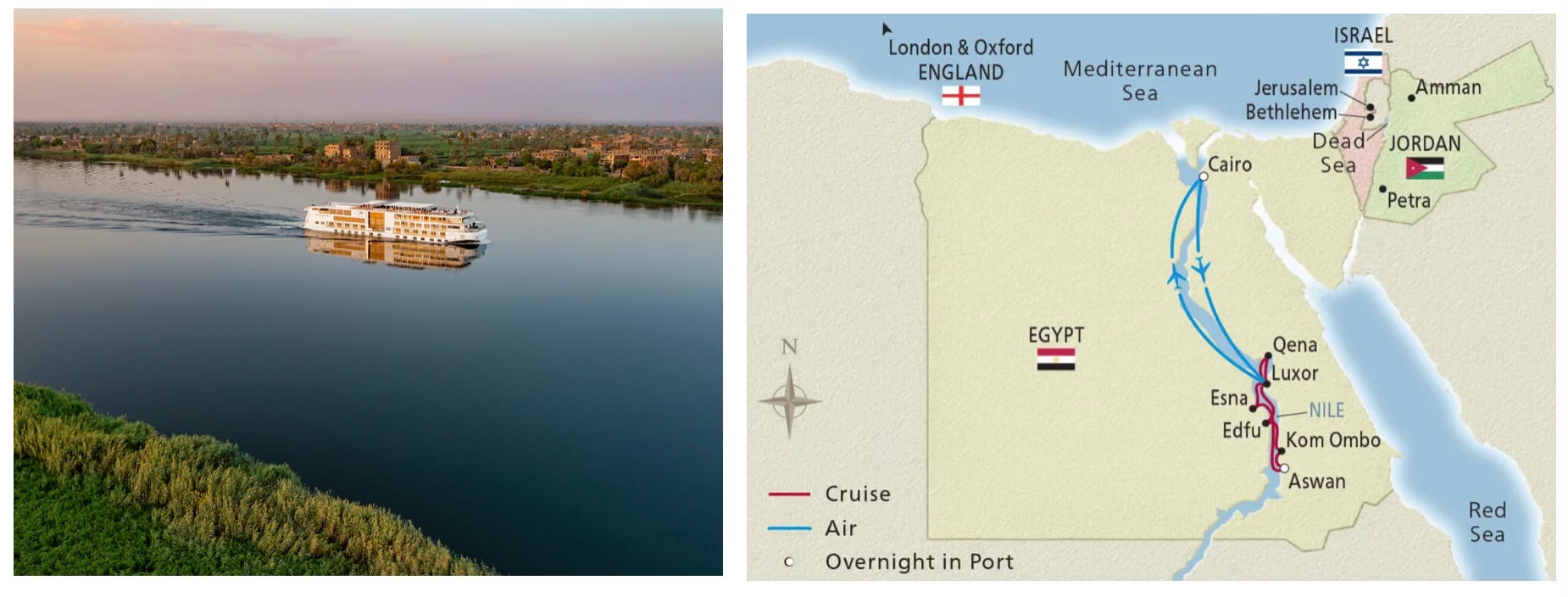

Third, Viking introduced their first newbuild Egyptian river ship after years of chartering and renovating secondhand ships. They plan to introduce three additional Egyptian vessels by 2025, but capacities are small (84 pax) relative to their overall size. A second southeast Asian ship will come in 2025 as well.

Viking may introduce more newbuilds for non-European products, but these are niches relative to the 60+ ships Viking has in Europe. Compared to competitors Uniworld and Ama, Viking offers few river products outside Europe. That could change, but growth outside Europe is likely to remain a small percentage of Viking’s overall river capacity.

Lastly, Viking Expeditions launched in December 2021, with the introduction of Viking Octantis. A second ship followed in 2022. This one, I’ll admit, seems the most self-indulgent. Most Viking ships have efficient layouts that are compact while enabling a premium experience. The expedition ships are huge on a per-person basis - they’re 63% the size of a Viking Ocean ship while carrying 41% of the passenger. Another comparison: Viking Octantis has 60% more space per passenger than the standard expedition ships from Ponant, itself a high-end brand.

Still, it makes sense for Viking to offer cruises to polar destinations to its loyal customers. And the expedition ships have another major advantage: they can transit the lock systems of the Great Lakes. In the summer, both Viking ships offer cruises from Toronto to Duluth. While it may make sense for Viking to expand further in the expedition segment, the ROI threshold for these ships is likely much higher than the other possibilities.

In addition to all these potential sources of growth, Viking continues to grow their existing segments. European river vessels have a short ordering window, so Viking will likely build as they see demand return post pandemic. Shipyard slots for the ocean ships are more competitive, so we have better visibility there. Viking has eight more ships on order, with talk of 10 total by the end of the decade.

They’re one of the most fun travel companies to watch, and I’m excited to see what comes next 😊

That’s it for this week. Thank you for reading!

To read the next article, click here!

🧾Sources & Additional Reading🧾

https://en.wikipedia.org/wiki/Viking_(cruise_line)

https://de.wikipedia.org/wiki/Viking_River_Cruises#Unternehmen

https://web.archive.org/web/20230000000000*/vikingrivercruises.com

https://www.travelweekly.com/River-Cruising/Rolling-on-the-rivers

https://www.travelweekly.com/In-the-Hot-Seat/Viking-Cruises-chairman-Torstein-Hagen

https://avidcruiser.com/2015/05/torstein-hagen/

https://www.travelweekly.com/Cruise-Travel/Insights/Viking-and-the-PBS-viewer

https://porthole.com/cruise-control-torstein-hagen-chairman-of-viking-cruises/

https://maritime-executive.com/magazine/viking-cruises-a-world-apart

https://rivercruiseadvisor.com/2015/04/size-matters-why-the-viking-longships-can-handle-190-guests/

https://www.prnewswire.com/news-releases/viking-launches-new-ocean-cruise-line-207843161.html

https://www.travelweekly.com/Cruise-Travel/Viking-unveils-ocean-cruise-plans

https://www.travelmarketreport.com/library/tmr/RiverCruiseReportCard2017-2018.pdf

https://www.travelagewest.com/Travel/Cruise/viking-saturn

https://cruiseindustrynews.com/cruise-news/2023/06/torstein-hagen-lays-out-his-plans-for-viking/

I think most people see Viking as an overnight success, but this article highlights the multiple decades of slow focused growth it took to build both the river cruising travel category and it's brand name.

Great read! Subscribe to this great travel blog!